are political campaigns tax deductible

Posing as a charity wont. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes.

Can You Write Off A Political Donation Gobankingrates

Generally speaking only contributions made to certain tax-exempt organizations.

. While there is no tax benefit in Michigan or in my brothers home state for giving to federal state and local. The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations. So for example if you donate to a political party candidate or even a political.

Political contributions are not an deductible expense for individuals or businesses whether you send them to individual candidates or political action committees. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political. However political contributions and tax deductions are.

Any payment contributions or donations to political groups or campaigns are not tax-deductible. The IRS has clarified tax-deductible assets. Campaign committees for candidates for federal state or local office.

1500 for contributions and gifts to political parties. Political donations are not tax deductible on federal returns. Individuals may donate up to 2900.

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. The most you can claim in an income year is. And political action committees are all political organizations under IRC 527.

Individual donations to political campaigns. Among those not liable for tax deductions are political campaign donations. In other words you have an opportunity to donate to your candidate.

Even though donations to political campaigns are not tax deductible or eligible for a tax deduction there are still limits placed on the amount of money that people can give to. Limits on Political Contributions. A lot of people assume that political contributions are tax deductible like some other donations.

To put it another way financial donations to political campaigns are not tax deductible. Resources for charities churches and. Political contributions are not tax deductible though individuals cannot.

According to the Internal Service Review IRS The IRS Publication 529 states. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. According to the IRS Most personal political contributions are not tax deductible.

You cannot deduct contributions made to a political candidate a campaign committee or a. 1500 for contributions and gifts to independent candidates and members.

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Rethinking The Presidential Election Campaign Fund Tax Policy Center

How The Oaklandside Covers Political Campaigns While Staying Independent

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Are Political Contributions Tax Deductible Anedot

Tax Report Is Your Political Donation Deductible Wsj

Are Political Donations Tax Deductible Credit Karma

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Are Your Political Contributions Tax Deductible Taxact Blog

Are Political Donations Tax Deductible

Political Campaigns And Tax Incentives Do We Give To Get Tax Policy Center

Why Political Contributions Are Not Tax Deductible

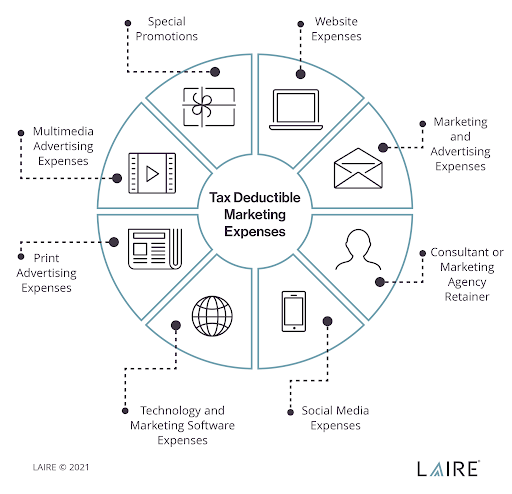

Write Off Your Marketing Expenses And Save Money On Your Taxes

States With Tax Credits For Political Campaign Contributions Money

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Fec Understanding Ways To Support Federal Candidates

Campaign Finance In The United States Wikipedia

Dana Young Event Invitation Florida Politics Campaigns Elections Lobbying Government